However, there are some exceptions to this rule. Thanks to the Tax Cuts and Jobs Act (TCJA) being passed in 2017, most people do not qualify for tax deductions on moving expenses. Are You Planning a Move in 2021? Let Us HelpĪre Moving Expenses Tax Deductible on Your Federal Income Tax Return?.7 States Where You Can Deduct Moving Expenses on Your State Income Tax Return.

#Are moving expenses tax deductible how to

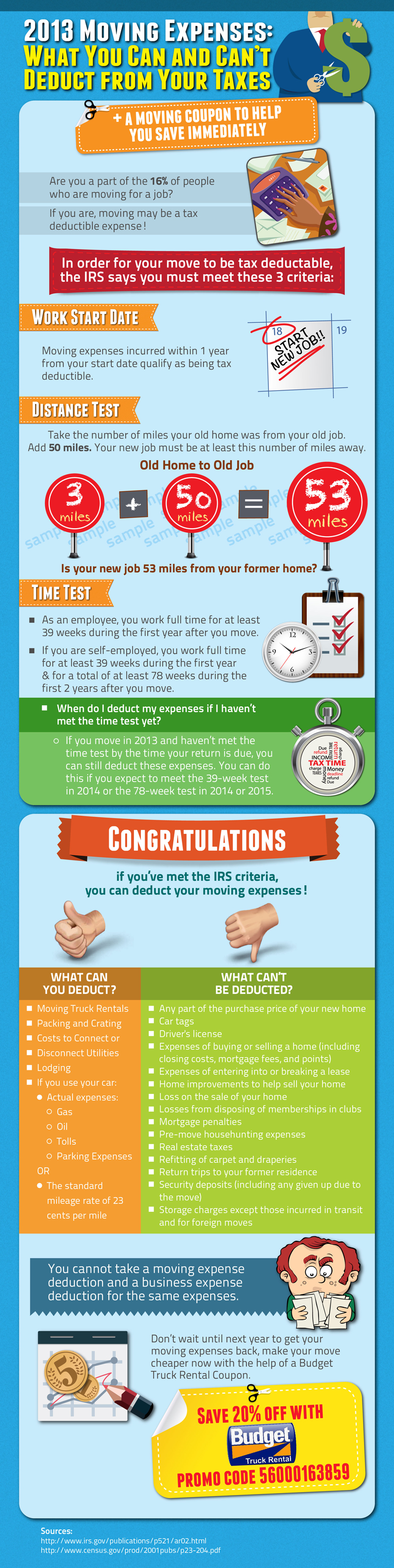

How to Claim a Moving Expense Deduction on Your Federal Income Tax Return.What Type of Moving Expenses Are NOT Tax Deductible?.What Type of Moving Expenses Are Tax Deductible?.Are Moving Expenses Tax Deductible on Your Federal Income Tax Return?.You recently moved and want to know, are moving expenses tax deductible?Ĭontinue reading this guide to learn if you are qualified to report moving expense deductions on your Federal Tax Income Return and State Tax Income Return. And no one wants to miss out on tax deductions. Members of the military can also qualify for the exemption more easily.It’s that special time of the year - tax time. If you’re forced to move due to a job in the military, the exemption still stands. Related: 15 Best Money Habits To Have When Renting an Apartment Military Exemption for Moving Expenses Deduction Other non-travel expenses such as short-term storage also qualified. Some seasonal work was allowed, such as teaching, if the work contract covered an off-season period of fewer than six months.Įxpenses that were considered “qualifying” were travel expenses such as lodging, gas and oil, and the standard mileage rate for distances driven, as computed by the Internal Revenue Service. Time Test: The time test required full-time work for at least 39 weeks within the 12 months after you moved. Here’s how the distance and time tests worked:ĭistance Test: The distance test required your new place of employment to be at least 50 miles farther from your home than your prior job. Up until tax year 2018, you could deduct all of your qualifying moving expenses if you passed two tests, one for distance and one for time. However, legislation is often overturned or rescinded, or in this case, slated to expire for tax year 2026, so it can be helpful to understand the prior provisions. This applies to state tax deductions as well, which are modeled on federal legislation. See: These Cities Have the Most People Moving In During the Pandemic Moving Expense Deduction Prior ProvisionsĪs the law currently stands, the moving expenses deduction will be suspended for the duration of the TCJA, which is being enforced from 2018 through 2025. The only exception is if you are a member of the military and are required to move.

Now, any moving expenses that aren’t reimbursed by your employer are your own personal responsibility, with no deduction allowed. However, that deduction vanished thanks to provisions in the Tax Cuts and Jobs Act, passed in December 2017. Prior to tax year 2018, the IRS granted a deduction for certain types of moving expenses associated with a change of address. Moving can be expensive, especially if you’re forced to move for a new job.

0 kommentar(er)

0 kommentar(er)